Update Tax Credits by 25 November if you are still working reduced hours compared to pre-Covid-19

What is the reason for this change?

As a way of supporting Tax Credit claimants who continued to work, but had their working hours reduced or were furloughed during the pandemic, HMRC did not require this type of change to be reported, and so during this time Tax Credit claimants working reduced hours have been treated as if they were still working their normal hours.

This temporary support is coming to an end from 25 November 2021.

What should I do now?

If you are back to your normal working hours before 25 November 2021 you do not need to inform HMRC. However, if your working hours remain reduced compared to what is shown on your Working Tax Credit claim, it is vital that you inform HMRC as you may have to repay any Tax Credits that you are no longer entitled to. You also may have to pay a penalty if you do not let HMRC know within one month.

Tax Credit claimants should inform HMRC about any permanent changes to their circumstances within one month, for example, if they are made redundant, lose their job or their hours change permanently during this time.

Any changes can be easily reported online at GOV.UK, where you can also check your current Working Tax Credit claim details.

What if this means I lose some, or all of my Tax Credits?

If, because of this change, you are no longer eligible for Tax Credits, or your entitlement has significantly reduced, you may be able to apply for other support instead, such as Universal Credit.

Advice and guidance

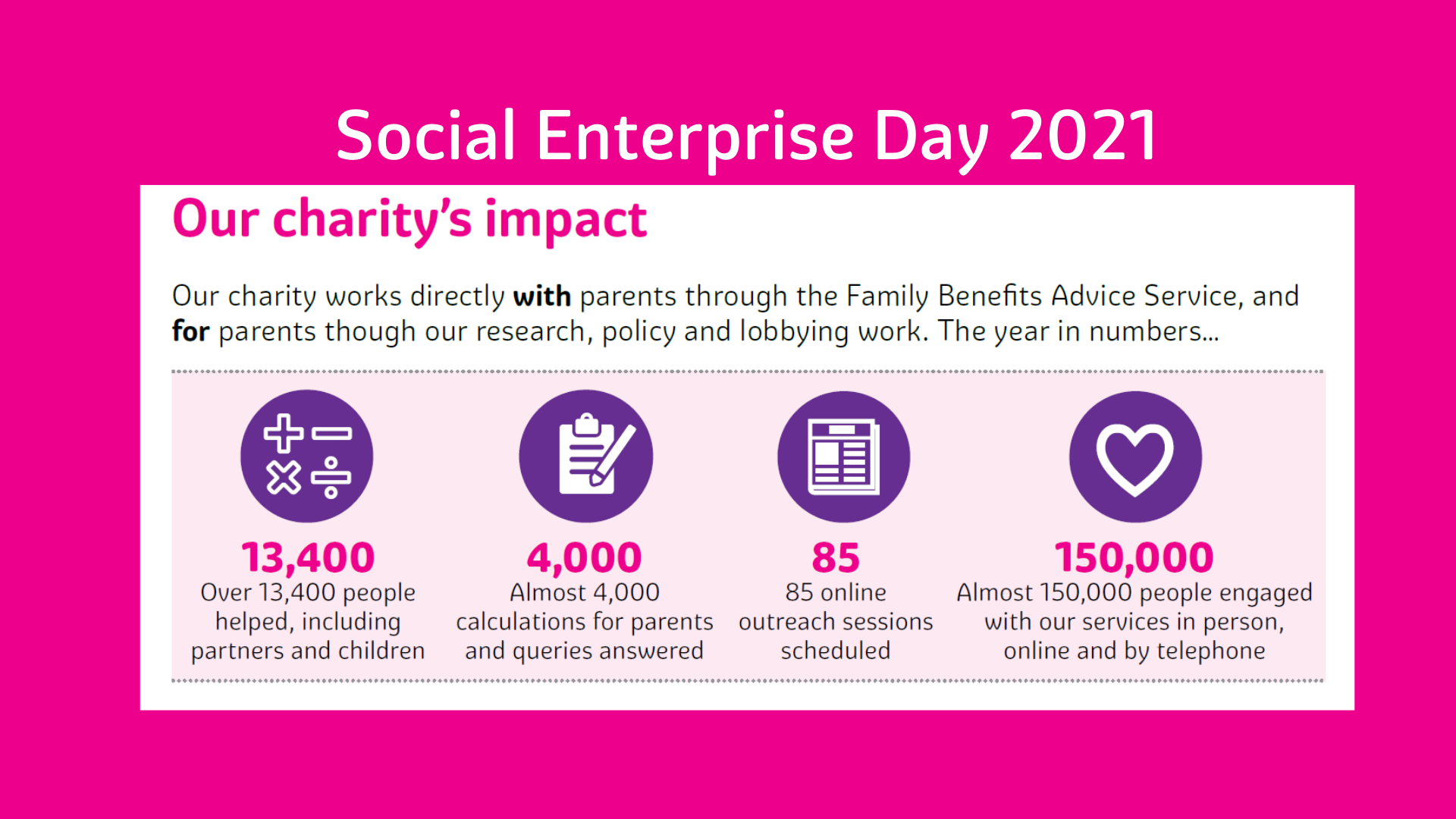

If you would like further advice on how this change may affect your entitlement to any benefits or help with childcare costs, or wish to find out more about what other financial support you may be entitled to, contact our Family Benefits Advice Service for free, impartial and confidential advice. Call us on 028 9267 8200 or email hello@employersforchildcare.org – we are here to help.