More families in Northern Ireland are now using Tax-Free Childcare to help with their childcare costs

The latest statistics from HMRC show that the number of families using Tax-Free Childcare has increased in the last year. The highest growth has been in Northern Ireland, where there was an increase of 48.8% in the number of families benefiting from the scheme over the last year.

Employers For Childcare has been working closely with colleagues from HMRC, and locally within the Department of Education, Department for the Economy, Health and Social Care and Family Support NI, to raise awareness, and promote the uptake, of Tax-Free Childcare. So it is positive to see an increasing number of families benefitting from savings of 20% on their registered childcare costs.

And yet still, our Family Benefits Advice Service regularly speaks with parents who either aren’t aware that they could be claiming financial support towards the cost of their childcare, or who are accessing the wrong form of support – and are potentially missing out on £1000s.

We’re encouraging all parents to make sure they’re receiving all the financial support they are entitled to with their childcare costs, and to check regularly that they are receiving the best form of support for their family, which may change depending on their circumstances.

There are a range of support schemes available including:

- Tax-Free Childcare

- Childcare Vouchers

- Universal Credit

- Tax Credits.

It can be complex to work out which scheme will provide the best support. We are here to help – our Family Benefits Advice Service can do a ‘better off’ calculation, looking at income and childcare costs, and help families to work out what is right for them. Below is a short overview of the Tax-Free Childcare scheme and how it supports working families.

What is Tax-Free Childcare?

The Tax-Free Childcare scheme allows eligible working families to claim 20% of their registered childcare costs, up to £2,000 per child per year, or £4,000 for a child with a disability, from HMRC.

For a family to be eligible, both parents need to be working (or one person in a single parent household), earning between £152 per week (equivalent to 16 hours working at the National Minimum Wage) and £100,000 per year each. So, for example, a household where each parent is earning £95,000 – with a combined income of £190,000 – would be eligible.

Self-employed parents are also eligible for Tax-Free Childcare. Households where one parent is working, and the other parent is in receipt of Carer’s Allowance or certain disability benefits can also qualify.

The scheme is available to parents of children under the age of 12 (or age 17 for children with disabilities).

Savings are not considered in determining if a parent is eligible for Tax-Free Childcare.

How does Tax-Free Childcare help with childcare costs?

For every £8 you pay into your child’s Tax-Free Childcare account, the Government will pay in a top up of £2, up to a maximum of £2,000 per year per child, £500 per quarter. A family would need to put in £8,000 across the year for the Government to top up their account with £2,000.

Note, if your child has a disability, you are still eligible to receive 20% of your childcare costs from the Government, but the cap on support is increased to £4,000 per year, or £1,000 per quarter.

The amount of savings a family will make through Tax-Free Childcare depends on their registered childcare costs – the scheme will be most beneficial for families who have higher childcare costs, as they will be able to claim a higher amount in support.

How do you sign up for a Tax-Free Childcare account?

Parents must register for an online childcare account through the HMRC portal available via www.childcarechoices.gov.uk. You will need to set up a Government Gateway account if you don’t already have one. It takes approximately 20 minutes to apply for a childcare account, and you’ll need details for yourself and your partner (if applicable) including date of birth and National Insurance Number. You can then set up an account for each of your children.

You can pay into your child’s account at any time and receive the top up, which will be paid within 24 hours, but is usually paid more quickly than this. Other people, such as family, friends and employers, can also pay into the account. Payments are then made directly to the childcare provider from each child’s online Tax-Free Childcare account.

Find out more

We have published a Comprehensive Guide to Tax-Free Childcare, available on our website here. For more information on Tax-Free Childcare or if you would like to find out if Tax-Free Childcare is the best form of support with your family’s registered childcare costs, contact the Family Benefits Advice Service on Freephone 0800 028 3008 or email hello@employersforchildcare.org.

How Tax-Free Childcare helps working families

Case Study 1: Beth and Robert

A couple who are both self-employed and making a joint profit of £64,000 per year recently contacted our helpline for advice. They wanted to know if they could get any support with their £18,000 childcare costs. We were able to identify an entitlement to Tax-Free Childcare of £3,600 per annum, which was the equivalent of £300 per month towards their childcare bill.

Case Study 2: Linda and Gary

A couple with a joint income of £120,000 recently contacted our helpline when their childcare provider gave them our number. They assumed that because they were high earners, they wouldn’t be entitled to any help with their £21,000 annual childcare costs. We were able to advise them that because neither of them earned over £100,000 they would be entitled to Tax-Free Childcare of £4,000 per annum.

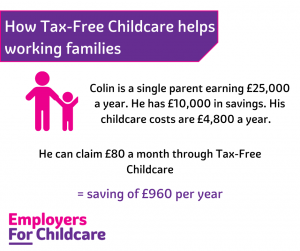

Case Study 3: Colin

A single parent contacted our helpline to see if he could get any help with his childcare costs as he did not qualify for Universal Credit due to their savings. We were able to tell him that his savings would not rule him out of Tax-Free Childcare so he would get 20% of the costs of his childcare cost paid saving £80 per month.