Find out if Tax-Free Childcare could help with your childcare costs

Most working parents are eligible for support with their childcare costs, yet our Family Benefits Advice Service speaks every day to parents who aren’t aware that they could be claiming financial help towards the cost of childcare. The Tax-Free Childcare scheme was introduced in 2017 but families in Northern Ireland account for just 2% of Tax-Free Childcare users across the UK – and we believe that many more families here could benefit from this form of support.

We would encourage all parents to make sure they are receiving all the financial support they are entitled to with their childcare costs, and to check regularly that they are receiving the best form of support for their family.

There are a range of support schemes available (Tax-Free Childcare, Childcare Vouchers, Universal Credit and Tax Credits) and it can be complex to work out what will provide the best support. We are here to help – our Family Benefits Advice Service can do a ‘better off’ calculation (looking at income and childcare costs) and help families to work out what is right for them. Below is a short overview of the Tax-Free Childcare scheme and how it supports working families.

What is Tax-Free Childcare?

The Tax-Free Childcare scheme allows eligible working families to claim 20% of their registered childcare costs, up to £2,000 per child per year, or £4,000 for a child with a disability, from HMRC.

For a family to be eligible, both parents need to be in employment (or one person in a single parent household), earning between £152 per week (equivalent to 16 hours working at the National Living Wage) and £100,000 per year each. So, for example, a household where each parent is earning £95,000 (combined income of £190,000) would be eligible.

Self-employed parents are eligible for Tax-Free Childcare, and households where one parent is working, and the other parent is in receipt of Carer’s Allowance or certain disability benefits can also qualify.

The scheme is available to parents of children under the age of 12 (or age 17 for children with disabilities).

Savings are not taken into account in determining if a parent is eligible for Tax-Free Childcare.

How does Tax-Free Childcare work in practice?

Parents must register for an online childcare account through the HMRC portal available via https://www.childcarechoices.gov.uk/. It takes approximately 20 minutes to apply, and you’ll need details for yourself and your partner (if applicable) including date of birth and National Insurance Number. You can then set up an account for each of your children.

For every £8 you pay into your child’s Tax-Free Childcare account, the Government will pay in £2, up to a maximum of £2,000 per year per child (i.e. a family would need to put in £8,000 for the Government to top up their account with £2,000).

You can pay into your child’s account at any time and receive the top up, which will be paid within 24 hours, but usually more quickly than this. Other people, such as family, friends and employers, can also pay into the account. You can then make payments directly to the childcare provider from each child’s online Tax-Free Childcare account.

The amount a family will save with Tax-Free Childcare will depend on their childcare costs – the scheme will be most beneficial for families who have higher childcare costs, as they will be able to claim a higher amount in support.

For more detailed information you can download our Comprehensive Guide to Tax-Free Childcare here.

For more information on Tax-Free Childcare or if you would like to find out if Tax-Free Childcare is the best form of support with your family’s childcare costs, contact the Family Benefits Advice Service on Freephone 0800 028 3008 or hello@employersforchildcare.org.

Case studies: How Tax-Free Childcare can help working families

Beth and Robert: A couple who are both self-employed and making a joint profit of £64,000 per year recently contacted our helpline for advice. They wanted to know if they could get any support with their £18,000 childcare costs. We were able to identify an entitlement to Tax-Free Childcare of £3,600 per annum, which was the equivalent of £300 per month towards their childcare bill.

Alex and Emma: A couple with a joint income of £120,000 recently contacted our helpline when their childcare provider gave them our number. They assumed that because they were high earners, they wouldn’t be entitled to any help with their £21,000 childcare costs. We were able to advise them that because neither of them earned over £100,000 they would be entitled to Tax-Free Childcare of £4,000 per annum.

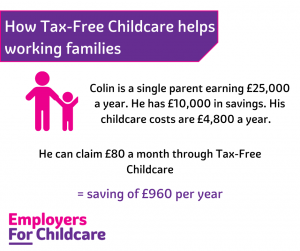

Colin: A single parent contacted our helpline to see if they could get any help with their childcare costs as they did not qualify for Universal Credit due to their savings. We were able to tell them that their savings would not rule them out of Tax-Free Childcare so they would get 20% of the costs of their childcare paid.